How To Make Your 401(k) Green

Most investors don’t think twice about the individual companies nestled within the funds in their 401(k) plans. Almost universally, investors are inadvertently investing in fossil fuels, gun manufacturers, and even companies with histories of treating women & minority employee groups unfairly.

The concept of avoiding offensive companies and instead buying corporations aligned with investor values has been around for decades. It’s referred to as Sustainable, Responsible, & Impact (SRI) investing.

According to a recent survey by Morgan Stanley, 75% of investors would consider sustainable investing1. With that amount of interest, it makes sense to explore investments that integrate environmental & social values within an employer sponsored retirement plan.

Here are three compelling reasons employers should consider adopting SRI investment options within their 401(k) plans.

#1 – MAKE PLAN PARTICIPANTS HAPPY

Most companies want to provide valuable benefits to employees. Adding SRI-themed funds to a plan creates a positive direct impact on employees who care about the greater good of society and the planet. Unlike adding insurance benefits, adding SRI investments to an existing plan can usually be accomplished at a net neutral cost.

We all know that happy employees make for better employees. Additionally, having SRI options can drive greater employee participation. Increased employee participation matters for certain types of 401(k) plans in that it allows owners to defer higher percentages of their compensation. Last, investors feel more “tied” to their SRI investments and generally stay committed to these strategies during challenging market downturns.

#2 – SRI INVESTING DOESN’T MEAN SACRIFICING PERFORMANCE

Long ago, many SRI investments were expensive and chronically underperformed. For this, SRI investing can suffer a bad rap. However, there is ample evidence2 suggesting that investments which incorporate positive Environmental, Social, and Governance (ESG) considerations exhibit strong corporate performance. More specifically, two recent studies from Morningstar and TIAA found that a performance penalty does not exist when sustainability factors are integrated within an investment portfolio3.

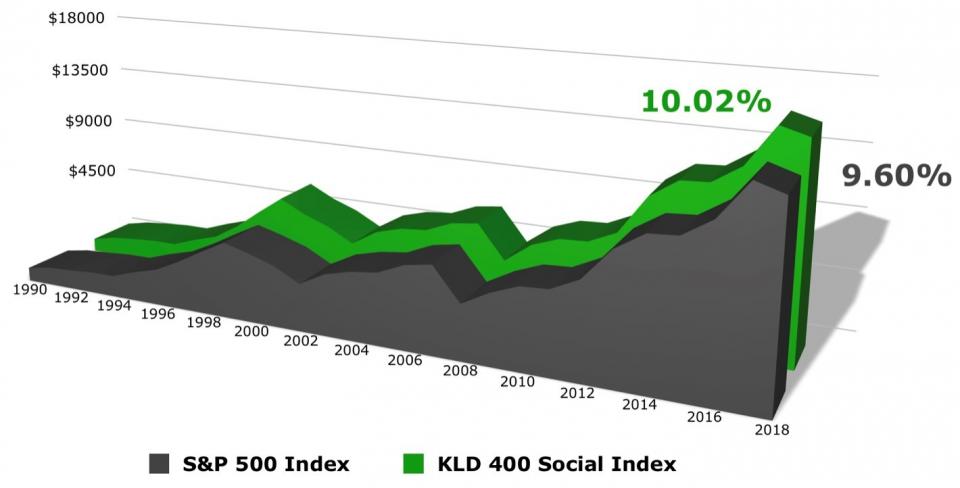

The empirical evidence paints a similar story. SRI investing is represented by the KLD 400 Social Index. First introduced in 1990, the index contains stocks demonstrating exceptional ESG ratings while at the same time divesting from historically poorly ranking stocks. Compared to its best fit benchmark, the S&P 500, the KLD 400 Social Index has outperformed since its inception almost three decades ago4.

KLD 400 Social Index Vs. S&P 500, 4/30/1990 – 12/31/2018

#3 – IT’S BENEFICIAL FOR PEOPLE AND THE PLANET

Keep the oceans blue, the forests green, and make people happy, right? Aligning these values with your investments is a natural extension of a responsible belief system.

Maintaining a positive environmental and social ethos benefits our planet and its people.

Ask your 401(k) administrator how to incorporate sustainable investing solutions into the retirement plan you offer employees. Not all 401(k) administrators or advisors have the expertise or capability to integrate SRI investments. There are also fiduciary obligations the Department of Labor has laid out that retirement plan sponsors must adhere to.

If your current plan administrator isn’t equipped to provide this level of guidance, there are a few options to consider, some that might even lower both your plan costs as well as those assessed to your employees. Reach out to us and we’ll be happy start a dialogue and offer assistance.

For additional information on Sustainable, Responsible, & Impact (SRI) investing, please visit our Website or reference these excellent posts from American Sustainable Business Council’s blog:

Putting Your Money Where Your Heart Is: A Strategy For Addressing Climate Change Use Your Investments To Protect The Environment.

- Sustainable Signals, New Data from the Individual Investor. Morgan Stanley Institute For Sustainable Investing, 2017.

- ESG and Financial Performance: Aggregated Evidence From More than 2000 Empirical Studies, Journal of Sustainable Finance & Investment, Friede, Busch, & Bassen, December 15th, 2015.

- Moving Beyond Exclusion: Sustainable Investing and Performance, Morningstar, based on research by Jon Hale, 2016 & Responsible Investing: Delivering Competitive Performance, TIAA Global Asset Management, O’Brien, Liao, and Campagna, April 2016.

- Underlying return data provided by Morningstar. Investors cannot buy an index directly, and past performance is no guarantee of future results. Chart design @ Aspen Leaf Wealth Management, LLC.

Aspen Leaf Wealth Management, LLC is a fee-only Registered Investment Advisor (RIA) based in Golden, CO. Please visit us at www.aspenleafllc.com.

We went out of our way to present unbiased data believed to be from extremely reliable and respected sources. However, its accuracy, completeness, and relevance are not guaranteed and no responsibility is assumed for errors or omissions. Historical risk and return performance is certainly no guarantee of future results, and there is no way to anticipate future changes to tax law. As such, we encourage you to discuss any financial strategy with your personal financial advisor and tax advisor, and remember to always read the prospectus before purchasing any investment.